Carbon markets in various places around the world seem to be running into trouble. In the US, the election of Senator Scott Brown in Massachussetts means that the cap-and-trade element of the Boxer-Kerry climate bill is likely to go. Down under in Australia the emissions trading plans of the Rudd government became the focus for the rise of new opposition leader Tony Abbott, who is tying to harness anti-tax sentiment to fight the scheme (already facing stiff resistance from the coal industry and other vested interests). Meanwhile, in the wake of the failure to agree a successor to the Kyoto Potocol in Copenhagen, various London-based banks are beginning to scale back their trading operations in the international market for Kyoto-linked carbon credits.

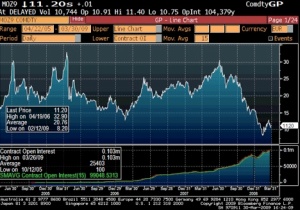

Even the global flagship carbon market, the EU emissions trading scheme (ETS), remains in the doldrums in the wake of the global recession and the Copehagen debacle. At around €13/tCO2, the carbon price is too low to drive much in the way of short-term emissions reduction, let alone low-carbon investment. The decision by the UK government last November to ban conventional new coal-fired power stations was a tacit switch of policy away from leaving new investment decisions to the market on the basis of carbon prices. And with Vincent de Rivas, CEO of French-owned EDF lobbying for more long term certainty and a “strong robust carbon price” to underpin nuclear power, it won’t be surprising if we see more interventions to try to shore up or bypass the market.

Given that emissions trading has been the central plank of climate policy, why has it been so hard to establish effectively? Realistically, carbon prices won’t be high enough to subsidise new, cleaner forms of energy for years to come. Instead, they just make existing dirty energy more expensive, as Shellenberger and Nordhaus of the Breakthrough Institute point out. Most people therefore see carbon pricing as a form of carbon tax (or energy tax), and as such it is simply unpopular. In the US and Australia, the legislation has been debated at the national level, in the full glare of the media, and so the schemes have higher profile, are better understood, and have faced stiffer opposition than the EU ETS which, (like much European law), is fairly invisible to the public. This is one reason why the ETS at least exists. But precisely because of its low profile, the ETS has been particularly vulnerable to industry lobbying, and as a result its early phases were pretty weak.

Does it matter that carbon markets are looking a bit wobbly, and is there an alternative? Carbon markets would have an impact on emissions, but even when prices get into the ranges expected, this is likely to be small. For example, a study by MIT recently produced some modelling suggesting that an ETS price of around €25/tCO2 (what we saw for a short period in 2005-06) meant at most a 3% cut in UK emissions, mainly through fuel switching in power generation from coal to gas. While useful, this is not (literally) going to save the planet, especially since it is a one-off change. And, not surprisingly with all the political uncertainties surrounding them, carbon markets have so far failed to drive any investment decisions.

At one obvious level, the main alternative to carbon markets is carbon taxes, although there are a host of reasons why they aren’t a simple alternative, not least because they would be just as unpopular as – if not more than – emissions trading. But at another level, given that we have no hope of radically reducing emissions without cheaper and more effective low-carbon energy technologies, the more important alternative to carbon markets is a step change in low carbon technology policy. Sadly, while the plight of carbon markets is getting the headlines, low carbon innovation remains overlooked.

Why not carbon taxes with revenue recycling? (could be called a carbon dumping fee with a dividend). This gives you the clear price signal and also evens out the burden of the tax or fee by income.

check out: http://www.carbonfees.org/home/

Getting out of the carbon trading paradigm is key to actually cutting emissions over the long term.

I’ve written a number of critical pieces on cap and trade here:

http://greenthoughts.us/policy/

Pingback: Tweets that mention Carbon trading in trouble « Political Climate -- Topsy.com

I have been getting the same sense of a cooling off by governments on any form of carbon pricing, be it cap and trade or taxes. Both mechanisms simply have way too many political and policy implementation challenges, in spite of it being the “right thing to do” according to economic theory.

The banking industry scandals in the U.S. related to market instruments must also be making climate policy makers around the world very nervous thinking that cap and trade may also be vulnerable to future “creative” investment schemes.

My sense is that governments now seem more prepared to spend public funds on clean energy technologies combined with perhaps “stealth” regulations that ramp up to these new clean energy technologies. Tougher fuel efficiency standards for cars that reach up to hybrids as the new auto standard; renewable energy portfolio standards imposed on utilities; perhaps carbon capture and storage technologies eventually as the next “best available technology” for coal-fired power plants. Additionally, although economic theory always advised that a strong enough carbon price would eventually stimulate clean energy technologies, low carbon prices and continued uncertainty re. C&T have been very slow in stimulating clean tech.

Call it the “technology/soft regulatory” approach (TSR for short). China might be the leading example of this approach. The TSR approach is a lot easier to get political acceptance for and to implement. It also tends to synchronize with energy development, future green tech marketing opportunities, job creation and perhaps to a future low-carbon economy (through technological transformation). Its overall effectiveness in delivering a given GHG reduction target is debatable, but it seems to be where much of the world is at!

Don Macdonald

MacEwan University

Alberta, Canada

Pingback: From Poverty to Power by Duncan Green » Blog Archive » Hacked emails; African remittances; leaving Haiti; the carbon slump; oil isn’t a curse; what happened in Davos; the BASIC coalition and a new ‘triple crisis’ blog: links

Pingback: Climate Policy Crisis « Political Climate